Lots of talks are happening around regarding future of condo market in Canada especially in world-clasc cities such as Toronto. The Condo market in Toronto has seen a boom in last few years due to following factors:

• Single family homes are in short supply in downtown area hence the prices for the same are sky rocketing. People are looking for more economical options and condos have proved to be the obvious, and frankly only choice.

• The demography of Canada is changing at a fast rate, the age group between 20 to 44 years, which is target market for condos is growing at faster rate compared with other metros from developed countries.

• Toronto Condominiums are a safe-haven for foreign investment and a secure place to see their money appreciate over time.

• To provide the boost to this sector, Government has adopted a policy of lower interest rates.

• The Canadian Government is keen on preserving the green land. This has led to additional floors on existing condos. Essentially, in downtown Toronto, there is no such think as a Greenfield

• Investors looked at it as a high return investments compared to capital market. Investors could get high returns as rents are high and interest rates are low.

Emotions also play an important role in any type of market and some fractions of the media has been creating a sentiment that the condos market bubble in Toronto is going to burst. On the other hand developers are assuring good returns from Condo market. Many economists have predicted that an increase in interest rates will have a negative impact on growth of condo market. However this will all depend on how the overall economy of the region is performing. A large number of employees in Canada work for financial services, Business services, Life sciences, green technology sectors. There is no reason that these sectors will see big downslide in near future. The countries like United Sates are showing good signs of growth in GDP. The Ontario merchandise export to United States has increased by almost 7-8 % in year 2011/12.

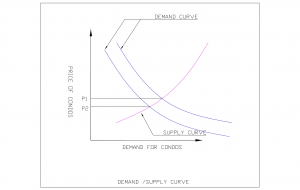

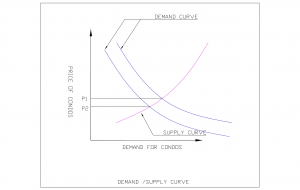

In worst case scenario the sharp increase in interest rate will reduce the demand of condos and create more default payments due to increase in EMI. As the supply will exceed demand, the prices will fall. Even if banks want to liquidate the properties, they will not have buyers who can pay mortgage amount. Hence the banking system will suffer badly. The government can’t afford to let this to happen. It will either take corrective action by reducing interest rates or by providing financial aid to the sector.

Condos market may see temporary drop in prices but it is going to be an investor’s hot destination on long term basis. Personally, we would like to see a lower sloped rise in Condo prices, as this will be a much more sustainable market as opposed to the exponential-seeming trend of recent prices.